Open an Account

Choose any product below to unlock your Premium Travel Membership (worth $199) on us.*

Savings Account

Free savings account that lets you earn dividends on balances higher than $500 per month.

Sky-High Savings

Save more money. Our High-Rate Savings account pays you 4.5x the bank national average.

Advantage Checking

A checking account that lets you earn dividends – plus a whole lot more!

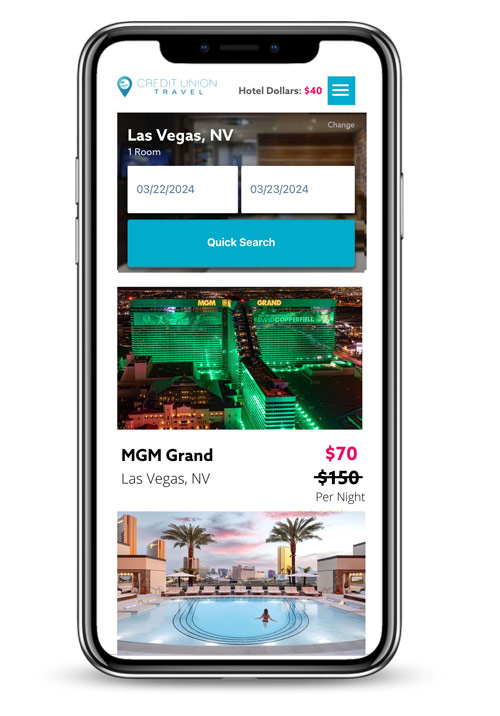

Become a Member & Unlock These Premium Travel Benefits4:

- Member-Only Hotel Deals (up to 70% OFF)

- $250 Hotel Dollar Sign-up Bonus

- Receive $10 hotel dollars every month

- 1 Companion Pass to share with a friend

- Earn 10% Hotel Dollars back on bookings

- Easy to use website experience

SkyOne, a true financial partner

Our products and services provide you with the tools and support you need to build a secure financial future. That’s why we were voted the Best of the Southland for 2023.

24/7 Access

Our online and mobile banking platform gives you access to your accounts any time, any day. Your personal digital branch.5

Branches and ATMs

Locate 66,000+ ATMs and 4,000+ shared branches near you through our nationwide network.

Introducing Zelle®

a fast, safe and easy way to send money to friends, family and other people you trust, wherever they bank.6

Early Pay Check

Get your pay check up to 2 days earlier with direct deposit.7

Everything you need

Industy high savings rates, checking, mortgage and HELOCs, reward credit cards, low loan rates, and more.

Your Financial Future

Our CFS financial advisors can help plan your retirement, education expenses, and more.8

Additional Member Benefits:

- Financial counseling with our trusted partner, BALANCE4

- Financial webinars with our trusted partner, BALANCE4

- Financial education for adults and children with our trusted partners, Everfi and Bite of Reality4

- Estate planning service with our trusted partner, Trust & Will4

- Wealth Management Consultation Services8

Disclosure

*A valid participant requires an individual who: 1) is 18 years of age and older 2) meets SkyOne’s membership requirements; 3) Open a Savings account from 12/04/2023 to 12/31/2023 through an in-person representative OR online; 4) deposits the minimum opening balance amount of $5; 5) maintains the new account in good standing for a period of thirty (30) days; and 6) maintains good standing with the Credit Union as a member for a period of thirty (30) days. A link to access CUTravel Premium Benefits will be emailed to email address provided at account opening within 10 business days of the account criteria being met.

1Savings Rate as of 12/22/2023 is 0.05% APY. APY=Annual Percentage Yield. The rate is variable and may change after the account is opened. A $500 balance is required to earn dividends. Dividends posted and compounded monthly. Fees may reduce earnings.Please refer to the Fee Schedule and All in One Disclosure for complete list of terms and conditions.

2Sky-High Savings Rate as of 12/22/2023 is 1.00% APY. APY= Annual Percentage Yield. SkyOne rates and terms are subject to change after the account is opened without notice. Compounding and crediting: Dividends will be compounded every month. Dividends will be credited to your account on the last day of each month. Dividend period: For this account type, the dividend period is monthly. For example, if the beginning date of the first dividend period of the calendar year is January 1, the ending date of such dividend period is January 31. All other dividend periods follow this same pattern of dates. The dividend declaration date is the last day of the dividend period, and for the example above, is January 31. If you close your account before dividends are paid, you will not receive the accrued dividends. Minimum balance requirements: The minimum balance required to open this account is $1.00. This account offers a set dividend rate of 1.00% with an Annual Percentage Yield (APY) of 1.00%. Dividends will be paid to the Sky-high Savings Account at a 1.00% rate with an APY of 1.00% provided a deposit of $1,000 or more is posted to your account each month. The deposit can be posted to any share account (suffix) within the same account to obtain the disclosed APY. There are no restrictions on the type of deposit method; direct deposit, remote check deposit, external transfers, ACH, etc. are accepted to fund your account each month. During the month, if there is no deposit of $1,000 or more credited to the account, the dividend rate and APY will default to the Regular Savings Account APY and APY disclosed on the current rate sheet. Average daily balance computation method: Dividends are calculated by the average daily balance method which applies a periodic rate to the average daily balance in the account for the period. The average daily balance is calculated by adding the balance in the account for each day of the period and dividing that figure by the number of days in the period. The period we use is the monthly dividend period. Fees and charges: Fees may reduce earnings. Savings and Money Market accounts have a maximum of six withdrawals or outgoing transfers per month. Please refer to the Fee Schedule and All in One Disclosure for complete list of terms and conditions.

3Advantage Checking Rate as of 12/22/2023 is 0.05% APY. APY = Annual Percentage Yield. Rates are effective as of the last dividend and declaration date. The rate is variable and may change after the account is opened. A $2,500 balance is required to earn dividends. Dividends posted and compounded monthly. Fees may reduce earnings on the account. Please refer to the Fee Schedule and All in One Disclosure for complete list of terms and conditions. The Advantage Checking account has a monthly fee of $5. To avoid the monthly fee, members must meet at least one requirement, each month. Select here, to see the options you have available to waive the $5 monthly fee

4SkyOne member benefits are provided by third parties, not by SkyOne or its affiliates. Providers may pay royalty fees to SkyOne for the use of its intellectual property. Some provider offers are subject to change and may have restrictions. Please contact the provider directly for details.

5Carrier message and data rates may apply.

6U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes and generally do not incur transaction fees.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

7You must have direct deposit on your account to enjoy this service. Early Arrival is based on the date that your employer sends SkyOne the funds for your paycheck. The actual delivery dates may vary in the event of holidays and other occurrences.

8Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and SEC Registered Investment Advisor. Products offered through CFS are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. The credit union has contracted with CFS to make non-deposit investment products and services available to credit union members.